There is a general impression, both in mainstream media and, more importantly, within HMRC, that up to 10% of claims for CJRS may be “inaccurate.” HMRC has announced that it will be enquiring into claims and it anticipates that about 25% of all claims will be looked into. Whilst we […]

Tag Archives: Tax Advice

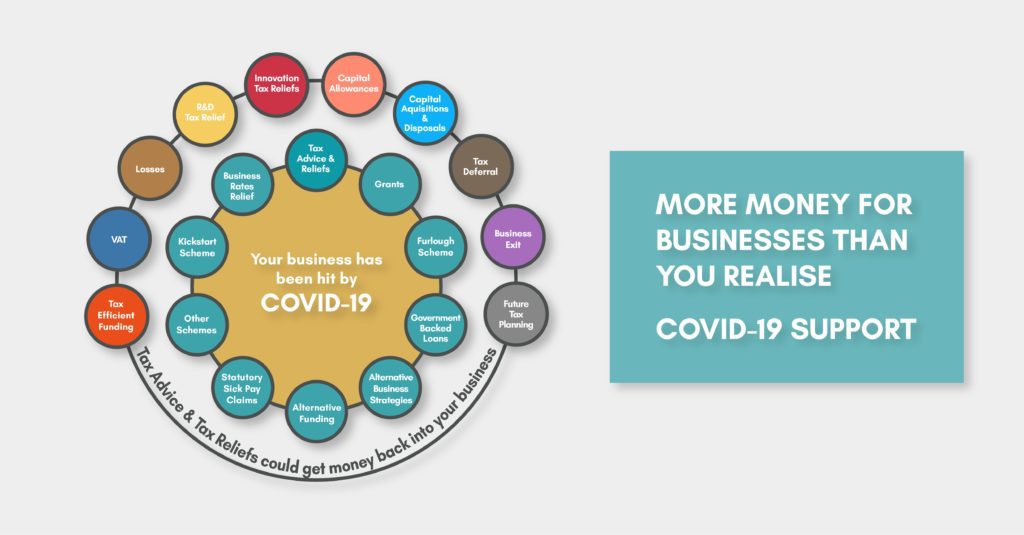

With a little glowing light at the end this long tunnel, we want to bring hope and open your eyes to tax advice options that until now you might not have considered for your business. More options than you realise. You’re probably feeling like you’ve exhausted all of the support, […]

Back in July 2015 the then Chancellor, George Osborne, announced a change to the way that tax relief for finance charges, in particular loan and mortgage interest, would be given against residential property rents. Rather than reducing the net profit of the residential property business, any tax due would be […]

Big changes are coming to the way in which VAT is administered to the construction industry. From 1 March 2021 the CIS VAT Domestic Reverse Charge Measure will apply to supplies of construction work. Proposals: When the reverse charge applies the customer must account for the supplier’s output VAT This […]

For tax professionals, the idea of escaping to some Spanish sun in January is a pipe dream, even in non-Covid times, as we grapple with the personal tax return submission deadline. And with Spain on the brain, we are advising clients to be aware of changes to EU tax […]

NHS Pension Members – Don’t forget to declare excesses from your 19/20 pension savings on your January Self Assessment return. If you have exceeded your Annual Allowance for 19/20 and you don’t have sufficient unused annual allowance to carry forward to cover the excess, you must declare this on your […]

IR35 has been around since April 2000 and exists to allow HMRC to challenge the employment status of those workers who provide their services via an intermediary, such as a limited company but who would be an employee if the intermediary was not used. HMRC refers to such workers as […]

Many employers like to reward their employees at Christmas – whether it be a party (and/) or a gift. However, the tax office is for life, not just for Christmas and unwary employers can fall foul of tax rules if the gifts aren’t of the correct sort and cost. The […]

HM Revenue & Customs have slightly changed the requirements for claiming the third tranche of the SEISS compared to the previous two tranches – but the result may have a major impact on the self employed’s ability to claim the SEISS. When claiming the first two SEISS grants the […]

COVID-19 has borne witness to increased public spending on an unprecedented scale. It has been estimated the UK is facing an annual bill of more than £300 billion to cover the cost of measures such as the furlough and self-employed support schemes. Earlier this year, Chancellor of the Exchequer Rishi […]