Usually, the mention of VAT makes people groan and mumble, probably because everyone has to pay it, whether it’s to fill up your car, ordering a pint, or even on a packet of Rolos as a treat for yourself (or maybe your kids if you’re feeling generous). Different Rates […]

Category Archives: VAT

To those of you in the hospitality and tourism sector, you have been enjoying a reduced rate of VAT (5%) since 12 July 2020. This reduced rate applies to most supplies made by hotels, tourist attractions, members’ clubs and most places that host events. It also applies to the food […]

What do these new VAT rules mean for UK sellers? From 1 July 2021, the VAT rules on cross border sales from business to consumer (B2C) have changed. A consumer being an individual or organisation that is not registered for vat. There is no longer a threshold for distance selling […]

Not many businesses operate without a bit of bad debt, although hopefully it is just the odd one! However, for tax purposes, there are different rules depending on the tax involved. VAT Relief On Bad Debts There are detailed instructions for VAT relief on bad debts which is set out […]

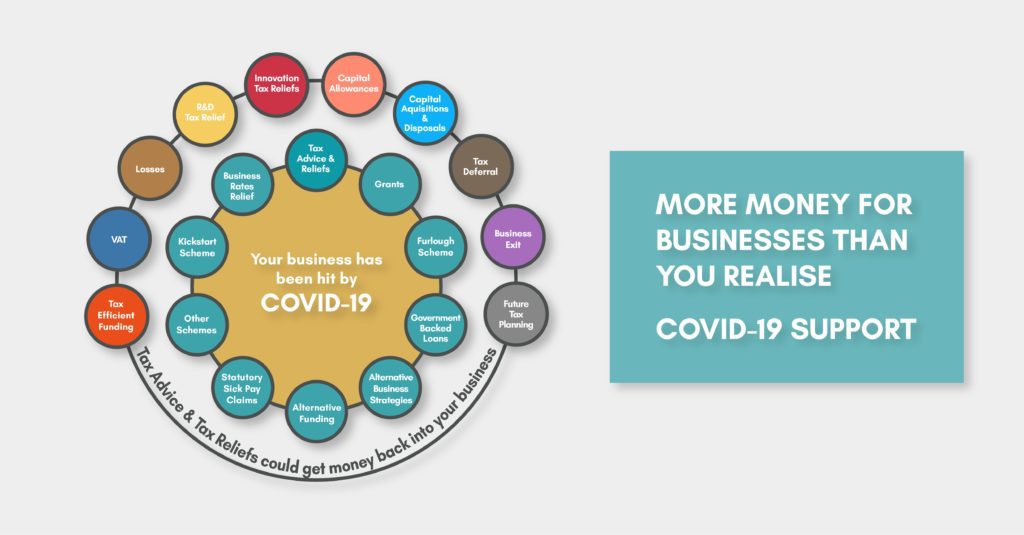

With a little glowing light at the end this long tunnel, we want to bring hope and open your eyes to tax advice options that until now you might not have considered for your business. More options than you realise. You’re probably feeling like you’ve exhausted all of the support, […]

Big changes are coming to the way in which VAT is administered to the construction industry. From 1 March 2021 the CIS VAT Domestic Reverse Charge Measure will apply to supplies of construction work. Proposals: When the reverse charge applies the customer must account for the supplier’s output VAT This […]

The rules regarding UK residency and UK tax position are not straightforward and we recommend that this is carefully reviewed to ensure your peace of mind. As well as the usual regulations, HM Revenue & Customs’ rules include a 60 day “exceptional circumstance” get out clause. However, this may not […]

The Government has today (15.07.20) temporarily reduced the VAT rate to 5% (from 20%) in order to support the hospitality sector on certain good or services. This reduction will apply to food and non-alcoholic drinks supplied by restaurants, pubs, bars, cafes and to hot take-away food outlets. The reduced rate […]