Tax, made digital. Many of you might know that tax is already digital now as the returns are done online. What this means is your records must be kept digitally. Making Tax Digital comes into force for sole traders and partnerships from 6 April 2023 with income from all sources […]

Monthly Archives: June 2021

Capital allowances are one of the most complex areas within UK tax legislation. A lot of the rules originally came from case law until the various decisions were legislated within the Capital Allowances Act of 2001. Broadly speaking, capital allowances are a tax-approved form of depreciation. Whereas accounting principles allow […]

Where do you want to go with your estate agency business? From our experience working with Estate Agency owners, we know two things to be true: You have a desire to improve your business in some way – not necessarily to grow and expand, but to create greater freedom for […]

In these tricky times, how do you as an employer remain profitable whilst trying to look after the wellbeing of your employees? Many employers ask us what an acceptable level of employee benefits is and of course this has to fit within their budget. The pension Since around 2012, […]

DIY Book-Keeper versus Accountant In all businesses there comes a point where you need to decide whether you complete the accounting yourself, hire a bookkeeper, or engage an accountant. To help make that decision it’s best to break it down to three key points: Needs – The first point to […]

GPs need to focus on their future financial planning just like the rest of us. Most GPs we talk to are working long hours in addition to patients with Covid, they are dealing with the fall out of long Covid, mental health issues exacerbated by the pandemic and also those […]

It is no secret that many governments have struggled to tackle the tax challenges that arise from an increasingly globalised and digital economy. However, following years of discussion, on 5 June 2021 G7 agreed to back an historic international agreement on a global tax reform, which will push for […]

Many of us buy clothing that, in reality, we only wear for work – and we are often asked if the cost of these clothes can be set against the tax bill. The short answer is no: HM Revenue & Customs is adamant that such expenditure has a purpose not […]

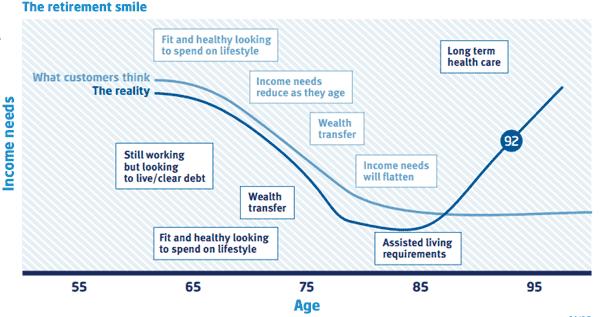

Financial planning – Why it’s better for your money to outlive you? When we put together a financial plan, we use a mortality of age 100 because we don’t want you to run out of money. We also use a financial planning forecasting tool to help you “see” your financial […]

In the 2020/21 tax year, just ended on 5th April 2021, as an employee you may have received extra support from your employer to enable you to continue to work. HMRC introduced a number of concessions so that these necessary support measures are not taxable benefits for employees. They include, […]

- 1

- 2